Social security taken out of paycheck

For more than 80 years through good times and bad Social Security has paid out. A single taxpayer earning 10000 in gross income in a given year for example.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

When Do You Stop Paying Into Social Security.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

. This helps your employer determine how much money it needs to take out of your paychecks. See our Social Security Payment Schedule for August 2021 for the dates when checks will be deposited this month including SSDI and SSI. Currently many retirees pay taxes on their Social Security benefits.

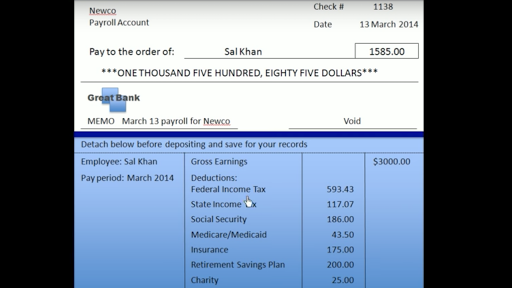

The amount withheld from your paycheck for FICA goes to Social Security and while most of that money is for retirement 15. More plainly this is the tax that funds the Social Security program. In its most basic form OASDI is Social Security taxes.

The Social Security Retirement Benefits program SS is a pay as you go insurance plan intended to supplement any other retirement plan you have. Your employer withholds 145 of your gross. Your marital status is one of many factors that will affect how much is taken out in federal taxes.

For example if you claim dependents your employer will take fewer taxes out of your paycheck. Only the social security tax has a wage base limit. Social Security Expansion Act Fact Sheet Social Security is one of the most popular and successful government programs in the history of our country.

Medicare taxes unlike Social Security tax go to pay for expenditures for current Medicare beneficiaries. The Open Social Security Calculator A Review. Social Security Taxes as an Example.

If youre trying to figure out when to claim social security I highly recommend spending 15 minutes with The Open Social Security CalculatorIt takes all of the complexity out of the topic and tells you in very simple terms when both you and your spouse should file for social security to maximize your. Workers pay into the program through payroll taxes taken out of their paychecks. A new bill though would get rid of those taxes and make up for the revenue by raising the cap on payroll tax payments from 147000 to 250000.

A new bill though would get rid of those taxes and make up for the revenue by raising the cap on payroll tax payments from. When you get paid your employer takes out income taxes from your paycheck. In other words even though 62 of your paycheck gets.

Currently many retirees pay taxes on their Social Security benefits. The wage base limit is the maximum wage thats subject to the tax for that year. This is true even if you have nothing withheld for federal state and local income taxes.

When you start a new job as an employee you provide your employer with your name address Social Security Number and other information to complete your W-4. Depending on your location you might pay local income tax and state unemployment tax as well. For earnings in 2022 this base is 147000.

Currently workers have 124 percent taken out of each paycheck and contributed to the Trust Fund half paid by. Social Security-- --Medicare-- --State Disability Insurance Tax-- --. The Social Security tax is a regressive tax which means that a bigger share of the total income.

If youre single or married and filing separately. A key fact to remember Social Security is similar to many 401k plans in that your employer matches your contributions dollar-for-dollar. Once you reach the maximum taxable earnings currently 142800 for calendar year 2021 withholdings from your employer will discontinue resulting in a higher paycheck says Mike Biggica a certified.

Family or financial obligations might require that you bring home a bigger paycheck each. This tax is automatically taken out of your paycheck and your employer must pay a matching amount as well. Usually you must have Medicare and Social Security withholdings on each paycheck.

As you work throughout your lifetime Social Security taxes are taken out of your paycheck. How Your Delaware Paycheck Works. The Social Security Expansion Act sponsored by Sanders and Senator Elizabeth Warren D-MA would lift the income tax cap and apply the Social Security payroll tax to all income above 250000.

Even if a household earns enough to avoid paying federal income tax the Social Security tax may still be deducted from their wages. The tax funds the payments of retiree benefits survivor benefits and Social Security disability benefits. Refer to Whats New in Publication 15 for the current wage limit for social security wages.

Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your paychecks. Skip advert There are ways you can lower. This has a big payoff for them because by delaying claiming Social Security until age 70 the percentage of their Social Security income that gets taxed is cut from 85 to 4833.

The Social Security Trustees annual report estimates that taxes on Social Security will total 451 billion in 2022 up from 345 billion in 2021. Or Publication 51 for agricultural employers. Earnings over 142800 are not taxed by Social Security or used to calculate future Social Security payments.

While Natalie and Juans retirement paycheck of 70000 remains the same they pay approximately 37 less in taxes and withdraw smaller amounts from. A financial advisor can help you figure out how Social Security will factor into your retirement plans.

Paycheck Taxes Federal State Local Withholding H R Block

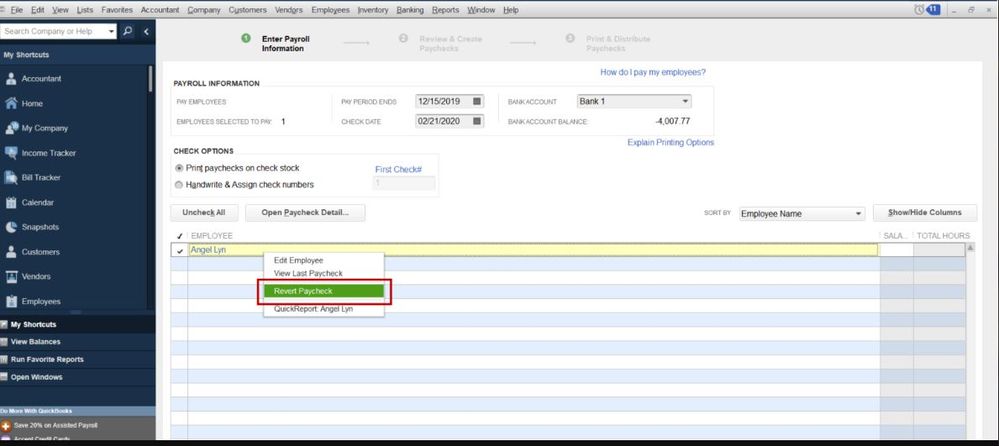

Is There A Way To Print A Social Security Number On The Pay Stub

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

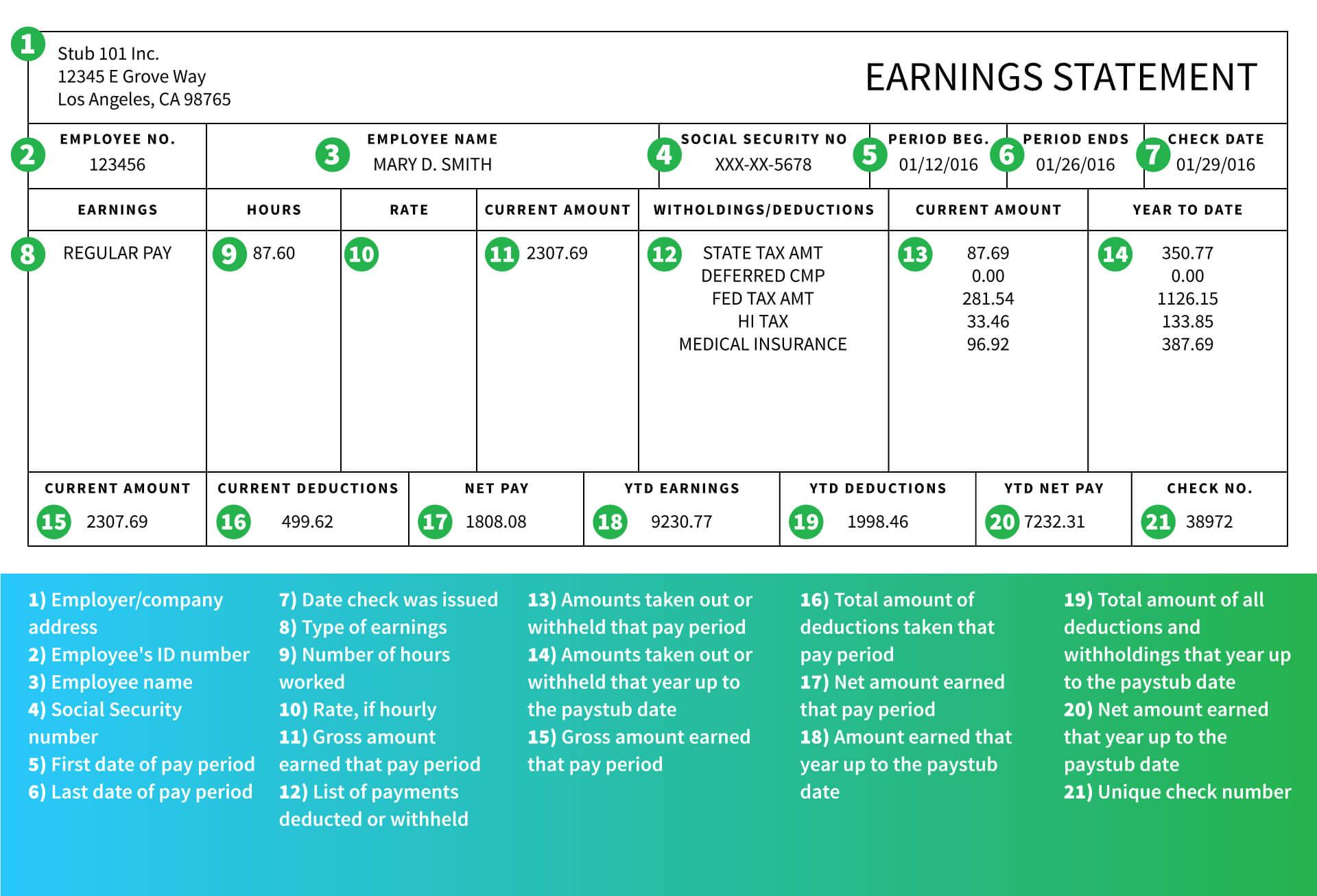

Understanding Your Paycheck Credit Com

Understanding Your Paycheck

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Annual Compensation Vs Annual Salary

Anatomy Of A Paycheck Video Paycheck Khan Academy

Solved No Medicare Or Social Security Tax Taken Out Of One Employee S Check

Pay Stub Meaning What To Include On An Employee Pay Stub

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

How To Read A Pay Stub Gobankingrates

Different Types Of Payroll Deductions Gusto

Common Pay Stub Errors California Employers Should Avoid

Is There A Way To Print An Employee Social Security Number On A Pay Stub In Qb Online

Trump S Payroll Tax Cut Would Terminate Social Security Critics Say

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time